Cook says Buffet’s sizable holding in Apple means it isn’t really a normal tech company

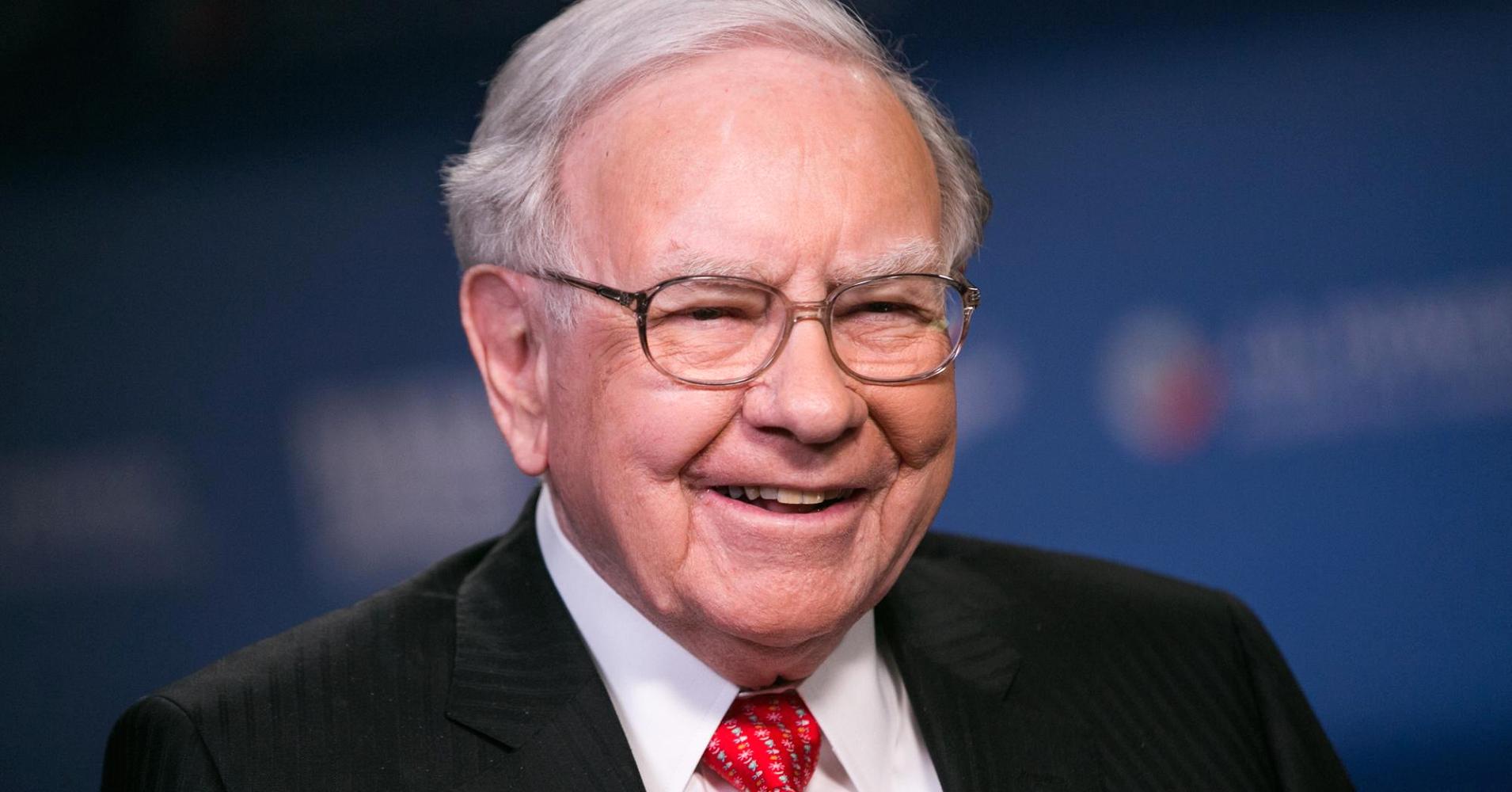

Following afterwards Berkshire Hathaway’s annual shareholder meeting, investor Warren Buffett sat downward alongside CNBC’s Becky Quick to hash out Apple, ane of his biggest holdings, alongside CEO Tim Cook commenting that the fund’s sizable asset inward his companionship shows that the iPhone producer isn’t actually a traditional applied scientific discipline companionship anymore.

Cook, who has attended the investor effect for the start time, has said that Buffett understands that Apple is actually a consumer products companionship at its core. The legendary investor typically avoids major investments inward applied scientific discipline companies, only a few years dorsum did brand an exception for Apple which he sees equally expert concern inward the long run.

Here’s the full Cook quote:

Buffett has been really clear, he didn’t invest inward applied scientific discipline companies as well as companies he didn’t understand. He’s been totally clear alongside that. And as well as thence he land views Apple equally a consumer company.

Berkshire Hathaway volition proceed to concur its considerable stake inward Apple, alongside Buffet pointing to Apple’s most recent profits equally a argue for his continued investment inward the company.

The investor told CNBC’s Becky Quick:

We haven’t changed our Apple holdings. I was pleased alongside what they reported. What they talked virtually as well as reported is consistent alongside the argue nosotros ain $50+ billion of Apple.

One of the reasons Buffet gets Apple is its approach to technology, Cook suggested:

We believe that applied scientific discipline should live on inward the background, non the foreground, as well as that applied scientific discipline should empower people to hit things as well as aid them hit things they couldn’t hit otherwise. We’re inward the applied scientific discipline industry, only nosotros operate at that intersection of applied scientific discipline as well as the liberal arts as well as the humanities. And as well as thence nosotros brand products for people, as well as and thence the consumer’s at the oculus of what nosotros do.

Cook added that Buffett’s organized religious belief inward Apple “seemed similar recognition” of this continuing evolution. “We run the companionship for the long term. And as well as thence the fact that we’ve got the ultimate long-term investor inward the stock is incredible.” Berkshire unveils its investment inward Apple inward Feb 2017.

“We purchase them to hold,” he told CNBC at the time.

Related

Buffet equally good acknowledged inward March that he wouldn’t live on concerned if the upcoming Apple TV+ master copy video streaming service didn’t boot the bucket an mo striking alongside consumers.

“I’d honey to catch them succeed, only that’s a companionship that tin afford a error or two,” he said, adding “You don’t desire to purchase stock inward the companionship that has to hit everything right.”

Berkshire Hathaway currently holds Apple stock worth over $50 billion.

Cook equally good told CNBC that Apple’s acquisition charge per unit of measurement has accelerated inward recent months. Thanks to its aggressive acquisition style, the companionship has purchased betwixt twenty as well as 25 startups inward the yesteryear vi months alone, including Texture which served equally a footing for Apple News+.

0 Response to "Cook says Buffet’s sizable holding in Apple means it isn’t really a normal tech company"

Post a Comment