Making Sense of Bitcoin’s Price Increase and Rollercoaster Ride

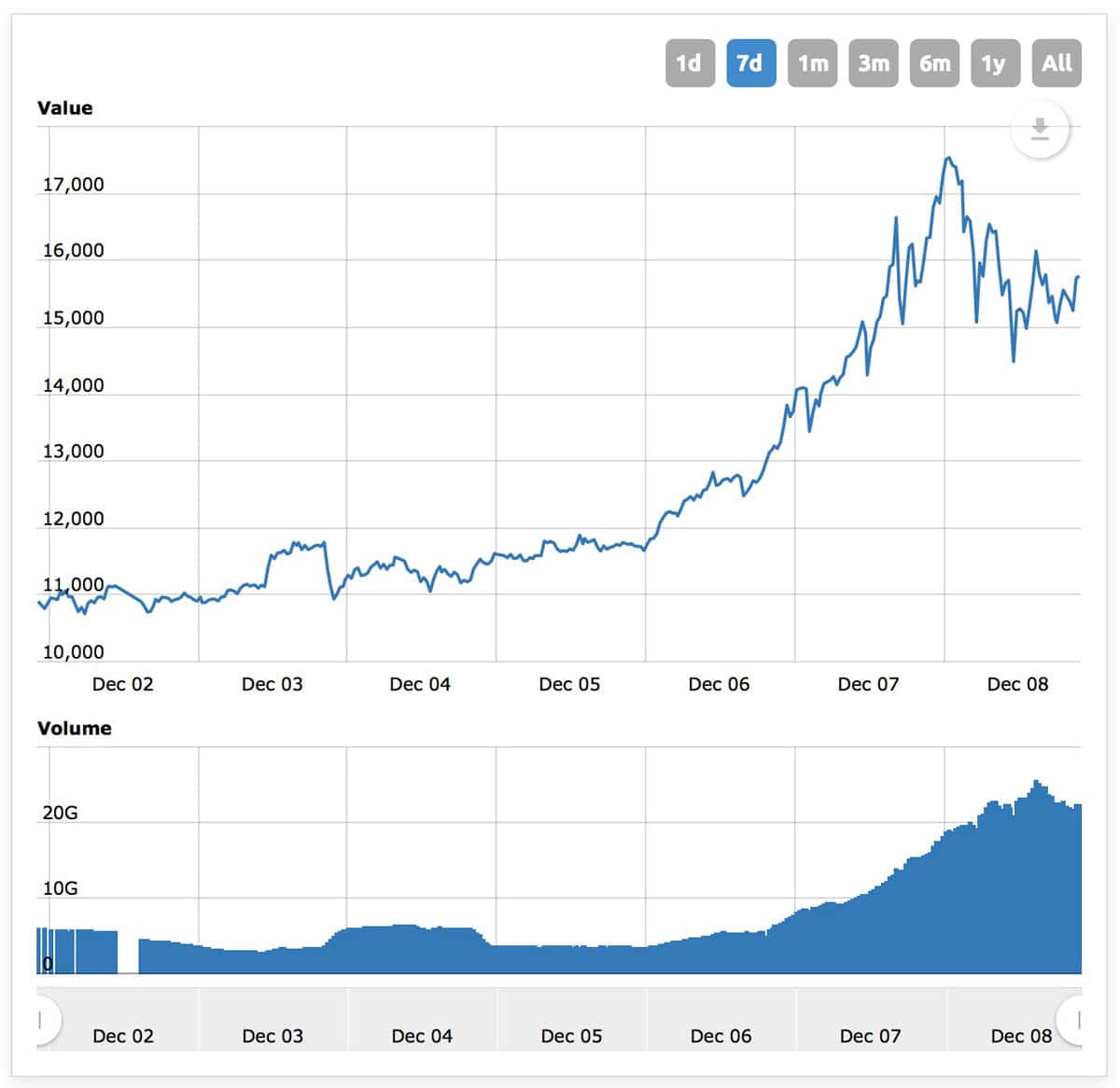

The price of Bitcoin has been shockingly volatile in 2017, and this is particularly true of the last few months weeks days. Bitcoin’s price has risen from US$11,000 to $16,000 in the last seven days, with stops along the way all over $17,000, $18,000, and even brief forays into $19,000 and $20,000 territory.

Here’s a chart for just the last seven days of trading:

Bitcoin Price Chart for the Last Seven Days

Which is insane.

And it begs the question why? The short answer is that no one knows precisely. As small as it is, even the Bitcoin market is too large to understand all of the forces at play. We can, however, examine those factors we do know, including market fundamentals, to try and wrap our heads around what’s happening. With any luck, this article might help you think about the future of Bitcoin, too.

But first, I have warnings and caveats for you.

This Article Is Not Investment Advice

From our Bitcoin primer from Thursday: I’m not advising you to buy Bitcoin. Bitcoin is insanely volatile right now. And worse, it might have peaked or it might be at the bottom of a huge climb to the moon. It could crash at any time. Or not. In 5 years, it could be worth $100,000 or zero. Or anywhere in between. Bitcoin’s past is no guarantee of its future.

And while I am not offering investment advice to anyone, an investing/gambling maxim is never risk more than you’re comfortable losing.

My goal with this article is to help people—especially those new to Bitcoin—begin to understand some of what is happening with Bitcoin’s price.

Why Stocks or (Digital) Commodities Rise

Bitcoin can be sent to other users and used to purchase goods and services (for instance, Overtock.com and Expedia). They can also be traded for fiat currency (i.e. government backed currencies) and other cryptocurrencies on exchanges like Coinbase. Those trades set Bitcoin’s value—it might be more accurate to say those trades represent Bitcoin’s value.

(You can also get tiny amounts of Bitcoin for free from bitcoin faucets. I have a detailed Bitcoin Faucet guide if you’re interested.)

In any market, prices rise when you have more people buying than you have people selling. Conversely, when more people are selling than are buying, the price falls. In the case of Bitcoin, what we’ve seen recently is that many, many new people are pouring lots and lots of money into Bitcoin. That is, at it’s most basic, why Bitcoin is rising.

Why Is All That Money Pouring Into Bitcoin?

The question then shifts to why people are bringing in new money to Bitcoin, and that’s where things get more complicated. Here’s what I’ve been able to suss out as contributing factors to Bitcoin’s rise:

- Pure speculation.

- Bitcoin futures being added to the Chicago Exchange on Monday, December 11th, 2017.

- Increasing awareness driving increasing buy-in in a cryptocurrency ouroboros.

- Limited Supply

- Fear of missing out (FOMO).

On page 2 of this article, I’ll dig into all of these factors more deeply and offer my conclusions.

Next: Digging Deeper into Factors Pushing Bitcoin Higher

Page 2 – Digging Deeper into Factors Pushing Bitcoin Higher

Pure Speculation

While Bitcoin does offers true utility—the ability to send money to anyone else in the world without needing to trust any third party—a tremendous amount of Bitcoin’s current valuation is assuredly speculative in nature.

Put another way, a lot of people have bought into Bitcoin believing it will be worth more in the future than it is today. They may or may not be right, but that belief has greatly contributed to Bitcoin’s rocket-like rise in 2017.

Some believe the huge rise has resulted in a bubble that will soon pop and leave a lot of people high and dry. They may be right. They may not be. People have been calling Bitcoin’s price a bubble since it hit a dollar a bitcoin. One of the better Hitler YouTube videos I’ve seen is from 2011 with Hitler ranting about paying paying 10,000 Bitcoins for a pizza when they were now worth $18.

The thing is we might be in a bubble, or we might be at the beginning of the wider world waking up to Bitcoin’s potential. I don’t have the magic answer to that—no one does, but Bitcoin appears to be holding at its new high levels as of this writing.

Bitcoin Futures on the Chicago Exchange

Another recent factor is the news that the Chicago Exchange will be adding Bitcoin futures starting on Monday, December 11th, 2017. This has had multiple influences on Bitcoin’s price.

For one thing, it’s seen by some as another sign of Bitcoin’s increasing acceptance as something that’s real. Being blessed—however obliquely—by the Chicago Exchange seems to make some people feel that investing in Bitcoin is safer.

Next, this move is making the rich and powerful on Wall Street sit up and take notice. These folks may be bringing some of the more serious money we’ve seen pour into Bitcoin.

This may include a big push to own a position in Bitcoin before those futures actually launch. If that’s the case, there’s no telling what will happen once they do.

Increasing Awareness Driving Increased Buy-In Driving Increased Awareness

This is sort of the human-nature segment of this piece: as Bitcoin rises in price, more people check it out and become interested. As some of those people buy-in, the price rises more, driving more headlines and attracting more people, some of whom buy in…etc. It’s somewhere between a virtuous circle and a vicious cycle, depending on your point-of-view.

Limited Number of Bitcoins

Bitcoin scarcity is absolutely playing a role in the current rise. With real-world commodities, an increase in price leads to more money people applied to production, which will increase the supply. A gold mine that isn’t profitable to mine at $1,000 an ounce could well be profitable to mine at $2,000 an ounce. A old steel mill that’s not profitable at $300 per ton may well be profitable to operate if steel were to rise to $750 per ton. Etc. etc. The more something is worth, the more incentivized people are to get or produce more of it.

With Bitcoin, however, more money applied to Bitcoin mining doesn’t result in more Bitcoins being mined. It only shifts who gets the same amount of Bitcoin that would have been mined anyway. (Note that this is a gross oversimplification, but it’s close enough for all but much more technical discussions).

This is because the Bitcoin network is designed to produce new blocks of Bitcoins every 10 minutes (on average). Throw more processing power at the network, and the network will make its math harder to do, an adjustment that happens roughly every two weeks.

It’s sort of a zero sum game. One party might get more of the bitcoins being produced by throwing more processing power at the network, but it comes directly at the expense of every other miner.

In total, there will only be 21 million Bitcoins produced. Some 16.7 million of them have already been mined. The remaining 4.3 million Bitcoins will take another 123 years (roughly) to be mined.

Related

So when you get lots of money being pumped into the market, the price can only go up because the supply is all but static.

FOMO

If we’re in a bubble, there’s no doubt that FOMO—the fear of missing out—is a contributing factor. It’s what happens when lots of people jump in on something after it’s already risen to its justifiable value, pushing it beyond that value.

The amount of money that’s poured into Bitcoin—transactional volume in the last 24 hours is more than US$5.7 billion—suggests this current rise is more than FOMO, though.

I can’t prove it, but my gut says we’re seeing some concentrated wealth being moved to Bitcoin. And while rich people aren’t always smart, I think there is some smart money involved.

Beware the Pump and Dump

A pump and dump is an old term that predates Bitcoin by forever. It’s the idea of driving the price of something up so that you can then sell your remaining supply at a much higher price. Bitcoin’s market cap is $262 billion. While huge, it’s small enough that it takes less money to move the price in one direction or another than, say, the U.S. stock market.

Plus, it’s an unregulated market.

The bottom line being we could be in the midst of a deliberate pump and dump scheme being perpetrated on the larger Bitcoin community by a cabal of crooks. I doubt that’s the case, but what do I know? Very little, aside from the fact that there are a lot of eyes—eyes smarter than mine—scouring the Bitcoin blockchain for information. I haven’t found even a whiff of taint in Bitcoin’s rise, other than a general uncertainty about the rise itself.

Still, if you’re interested in Bitcoin, you must be aware of those dangers.

Conclusions

I don’t know exactly why Bitcoin has leapt in price, but I think it’s a confluence of many factors. That includes an increased awareness in Bitcoin and cryptocurrency as a viable technology with important commercial uses.

I also don’t know if Bitcoin is going to crash or keep rising. What I do know so far is crashes have been temporary setbacks. I also know that past performance is no predictor of the future.

In short, I’m cautiously optimistic, and keenly aware that my tiny stake in Bitcoin could be worthless at any moment. But everyone’s risk tolerance is different. I encourage anyone looking at Bitcoin to research as much as they can and understand their own risks.

0 Response to "Making Sense of Bitcoin’s Price Increase and Rollercoaster Ride"

Post a Comment