T-Mobile enters mobile banking with a new Money service

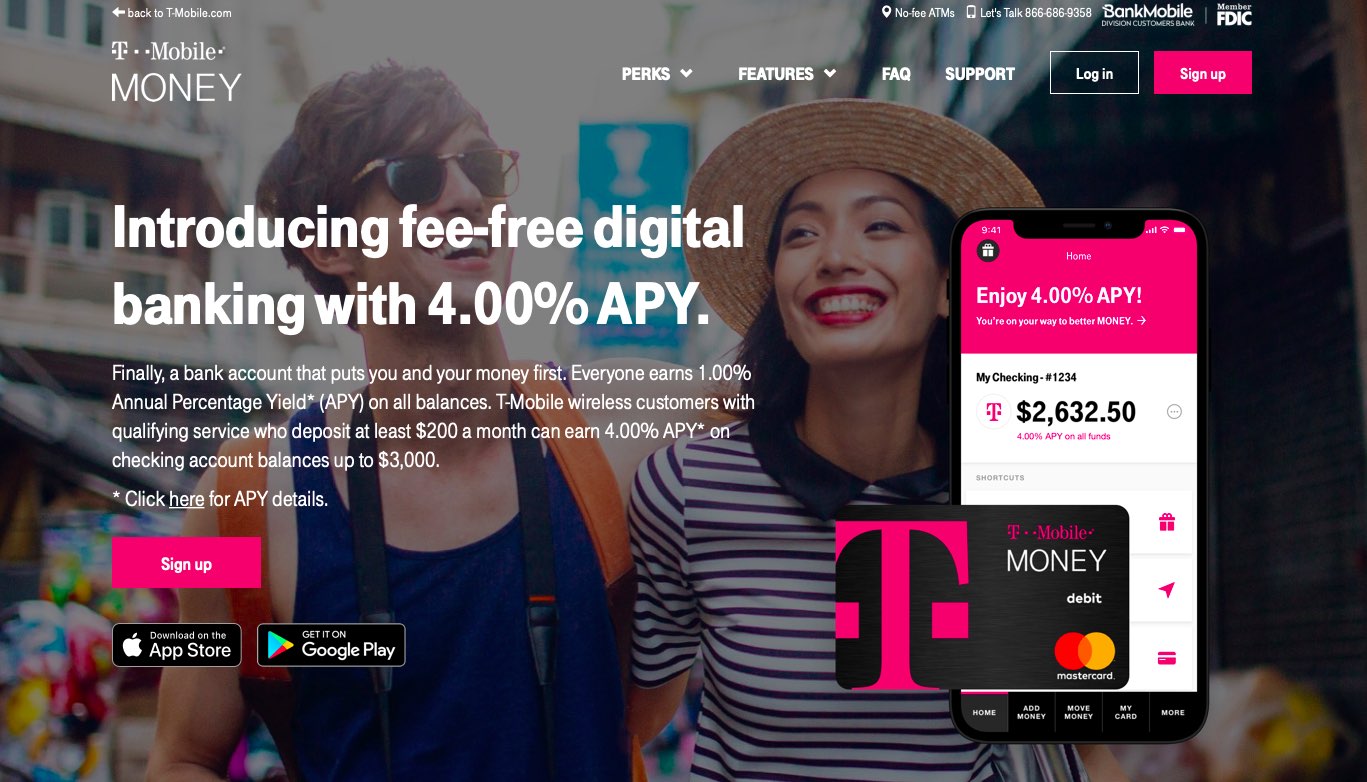

Wireless carrier T-Mobile on Wed quietly unveiled a mobile banking service of its own, T-Mobile Money, available every bit a gratuitous mobile app for iPhone together with Android.

While non officially announced, Domain Name Wire has discovered the official website at t-mobilemoney.com which launched today consummate amongst T-Mobile branding together with details. The service was too added to Google Pay’s master copy list of the US banks together with credit carte du jour companies.

As role of T-Mobile’s typosquatting prevention plan, it yesterday registered to a greater extent than than seventy typos together with variations of the t-mobilemoney.com together with tmobilemoney.com domains, which Domain Name Wire thinks shows that the carrier is going big on this novel service. T-Mobile is promising no draw of piece of job organisation human relationship fees, no maintenance fees together with no minimum balances.

Accounts are operated by BankMobile, a sectionalisation of Customers Bank, thence it industrial plant similar a typical bank. The only major downside to T-Mobile Money is the lack of a uncomplicated mode to deposit cash. “Instead, you’ll involve to larn a coin gild or cashier’s banking enterprise fit together with utilisation mobile deposit, or deposit into about other banking enterprise together with movement those funds to your T-Mobile Money account,” writes 9to5Google.

The pitch goes something similar this:

T‑Mobile Money is the banking enterprise draw of piece of job organisation human relationship that puts y'all together with your coin first. Everyone earns 1.00% Annual Percentage Yield (APY) on all balances together with T‑Mobile wireless customers amongst qualifying service who deposit at to the lowest degree $200 a month tin compass the axe earn an industry-leading 4.00% APY on checking draw of piece of job organisation human relationship balances upward to $3,000.

This comes amongst about caveats thence hold upward certain to read the FAQ.

For instance, y'all earn the aforementioned APY yield on balances upward to $3,000 each month if y'all convey a qualifying wireless plan, convey registered for perks amongst your T‑Mobile ID together with convey deposited at to the lowest degree $200 inwards qualifying deposits to your checking draw of piece of job organisation human relationship inside the electrical flow calendar month.

“If y'all run into this deposit requirement inwards a given month nosotros volition pay y'all this create goodness inwards the subsequent month every bit an added value provided all other requirements are met,” notes the carrier. Balances inwards a higher identify $3,000 inwards the checking draw of piece of job organisation human relationship earn 1.00% APY.

The digital finance service industrial plant amongst Google Pay, Apple Pay together with Samsung Pay.

Other features include total access to banking enterprise accounts, including mobile deposits, an ATM locator, access to 55,000+ fee-free ATMs worldwide amongst the Allpoint ATM Network together with more.

Here are the fundamental features of the mobile app:

- Pay the mode y'all want. Your T‑Mobile Money draw of piece of job organisation human relationship includes a debit carte du jour amongst EMV chip, addition it industrial plant amongst Apple Pay.

- Hassle-free mobile banking. Easily transfer coin to together with from your external accounts for free. Send a check, pay bills, or at i time deposit a component or all of your paycheck to your draw of piece of job organisation human relationship – all amongst simply a few taps inwards your T‑Mobile Money app.

- Stay connected to your money. Access your coin anytime amongst the app together with savour 24/7 client support.

- Safe together with secure. Prevent unauthorized draw of piece of job organisation human relationship access amongst multi-factor authentication. Log inwards amongst Touch ID together with Face ID. Enable or disable your debit carte du jour remotely if it’s lost or stolen. Accounts are FDIC-insured upward to $250,000. Plus, amongst Zero Liability Protection from Mastercard® you’re protected when fraud occurs.

The company’s mobile banking computer programme for the unbanked, called Mobile Money, was phased out inwards 2016 thence it seems that what we’re having hither is a novel maiden amongst a similar name.

T-Mobile Money is a gratuitous download from App Store.

0 Response to "T-Mobile enters mobile banking with a new Money service"

Post a Comment