U.S. Banks Halt Bitcoin Purchases with Credit Cards, China Plans to Block Foreign Exchanges

Bitcoin was hit by two bits of bad news Monday, sending cryptocurrency markets to multi-month lows. Chinese regulators announced plans to block access to foreign exchanges via the Great Firewall, and three major U.S. banks announced a halt to cryptocurrency purchases using their credit cards.

Bitcoin traded at $7,325 on Coinbase‘s GDAX platform as of this writing, down roughly $1,000 from Sunday, and down almost $2,000 since Saturday. The cryptocurrency had been rallying back to more than $9,000 on Saturday.

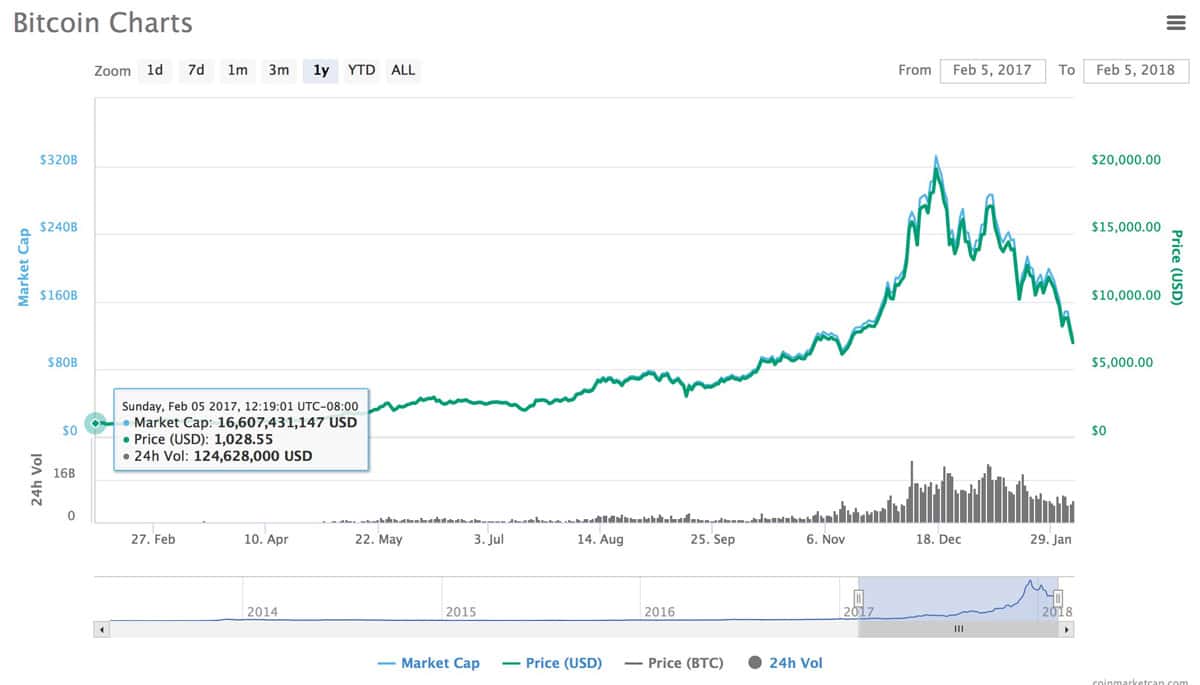

One Year Chart for Bitcoin (Source: CoinMarketCap)

China Regulators

English-language The South China Morning Post reported Monday that the state regulators announced a crackdown on domestic participation in both foreign cryptocurrency exchanges and Initial Coin Offerings (ICO) markets. Coupled with a September crackdown on domestic cryptocurrency exchanges and ICO markets, this move makes it much harder for Chinese citizens to participate in Bitcoin and other cryptocurrencies.

Hard, but not impossible. Intrepid cryptocurrency enthusiasts in China can use VPNs to access cryptocurrency markets, but China has long been trying to crack down on VPNs, too. To wit, the communist country forced Apple to remove VPN apps from its App Store in 2017. It is still possible to use VPN services, however.

U.S. Banks Gunshy

U.S. banking giants JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc. also announced their own private Bitcoin crackdowns Monday. According to Bloomberg, these three banks have stopped allowing cryptocurrency purchases at exchanges using credit cards they’ve issued.

At issue is the massive volatility of cryptocurrencies, including Bitcoin. The chart above is the last year of trading, and while Bitcoin is still up more than 600% year-over-year, it’s down significantly from its all-time high of $19,500 set in December.

That volatility puts the banks at risk, as they’re worried that traders or investors who bet wrong won’t be able to repay their credit card debt. Though to be fair, looking at the chart above, it might have made a lot more sense to decide this in October, when Bitcoin was already on a tear, than now, but hey, I’m not a banker.

Debit cards and direct transfers to and from bank accounts were not affected by this weekend’s banking decisions.

What Has Happened Before

Bitcoin has seen these selloffs many and more times. Heretofore, they’ve always then given way to rallies.

It’s impossible to know if what has happened before will happen again, but Bitcoin enthusiasts have a word for describing their philosophy: HODL. It stands for “hold on for dear life.”

In the meanwhile, if you’d like to earn some Bitcoin without buying it with fiat currency, check out our Bitcoin faucet guide. And the good news there is that faucets pay out more Bitcoin when prices are lower.

The author of this piece holds a tiny amount of Bitcoin that was not an influence in writing this article.

0 Response to "U.S. Banks Halt Bitcoin Purchases with Credit Cards, China Plans to Block Foreign Exchanges"

Post a Comment