EU Says Apple Owes €13B in Back Taxes, and the Fight is On

The European Union says Apple owes €13 billion (about US$14.5 billion) in back taxes because Ireland gave the iPhone and Mac maker illegal and unfair tax advantages. Apple and Ireland have both condemned the ruling maintaining they acted within the country’s laws, and are planning to appeal the ruling.

EU says Ireland undercharged Apple €13 billion for taxes

The EU’s ruling follows an investigation into the taxes Apple paid in Ireland between 2003 and 2013. The conclusion of the investigation, which started in 2014, was that Ireland broke EU laws to give Apple an unfair tax advantage.

Margrethe Vestager, who is in charge of the European Commission’s competition policy, said,

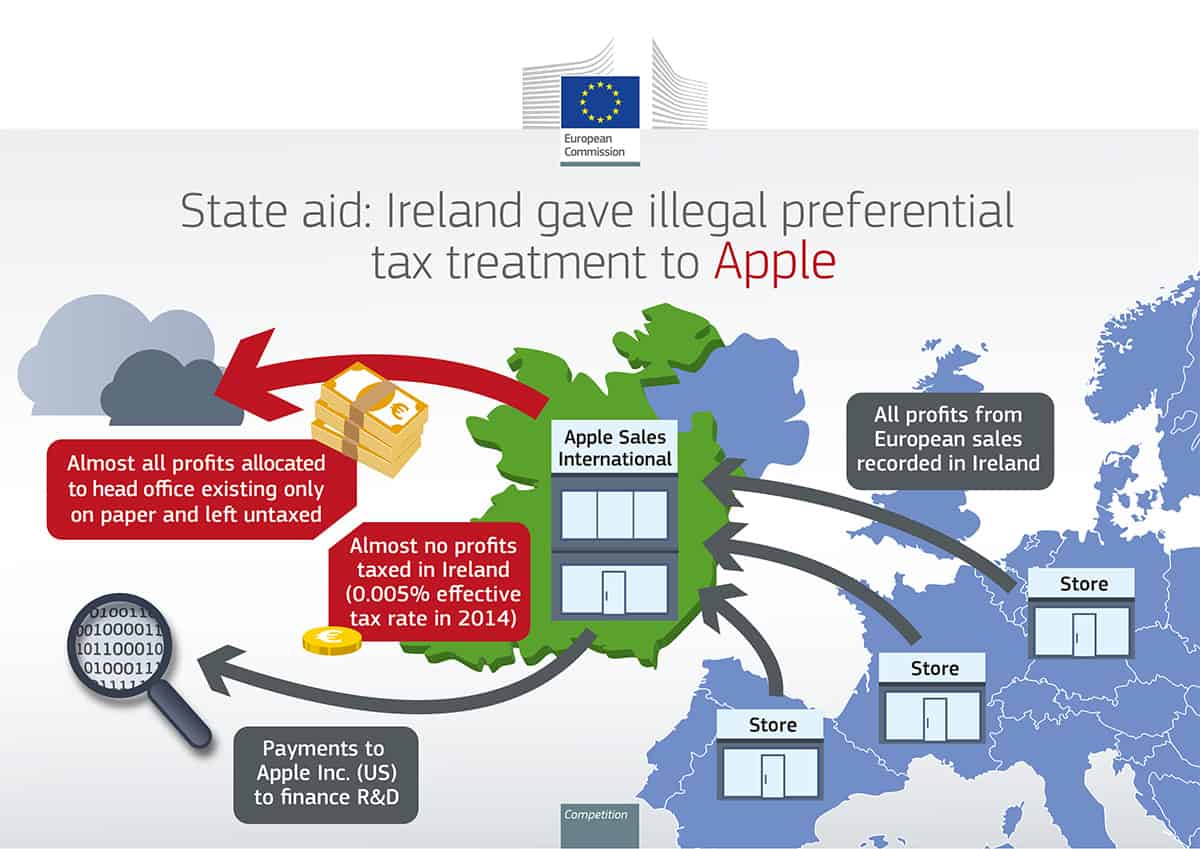

The Commission’s investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years. In fact, this selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.

Apple’s declining tax payment percentage, according to the Commission’s finding, comes from paying the same amount each year while company profits climbed.

The EU’s Case

According to the investigation’s findings, Apple funnels its profits from sales in Europe into Ireland-based Apple Sales International. Some money is paid to Apple in the United States to fund research and developments while most is diverted to an entity known as the “head office” where it isn’t taxable. The “head office” is apparently a company on paper without ties to any specific country, and as such aren’t taxed, according to the EU.

“The Commission concluded that the tax rulings issued by Ireland endorsed an artificial allocation of Apple Sales International and Apple Operations Europe’s sales profits to their ‘head offices,’ where they were not taxed,” the EU said in a statement. “As a result, the tax rulings enabled Apple to pay substantially less tax than other companies, which is illegal under EU state aid rules.”

The EU’s jurisdiction for recovering extra taxes in cases like this goes back ten years from the the start of the investigation. Since the investigation started in 2013, the potentially collectable back taxes goes back to 2003.

Apple’s Case

Apple’s response to the EU ruling was clear and damning. CEO Tim Cook penned an open letter criticizing the investigation and its findings. He said,

The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process. The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law. We never asked for, nor did we receive, any special deals. We now find ourselves in the unusual position of being ordered to retroactively pay additional taxes to a government that says we don’t owe them any more than we’ve already paid.

He went on to call the ruling unprecedented with wide-reaching implications, and a move to retroactively change Ireland’s tax laws.

“At its root, the Commission’s case is not about how much Apple pays in taxes,” Mr. Cook said. “It is about which government collects the money.”

Mr. Cook said Apple will appeal the ruling, which makes sense not only from a fiscal standpoint, but also because no laws were broken. Apple acted within the boundaries of Ireland’s tax laws and under the advice of the local government.

Next up: Ireland’s reaction

Ireland’s Reaction

Like Apple, Ireland plans to appeal the ruling, although its motivation goes beyond what Apple’s tax bill should be. This is about sovereignty, and Ireland’s government won’t cede control over its tax laws without a fight.

Ireland’s 12.5% corporate tax rate has been a strong catalyst for the country’s economy, drawing in thousands of jobs. Its tax laws are a key part in drawing major corporations into the country, and that’s an advantage the government doesn’t want to give up.

EU says Apple funnels money into Ireland for tax protection

The EU said, “This decision does not call into question Ireland’s general tax system or its corporate tax rate.” That seems a bit disingenuous considering the ruling is a direct attack on Ireland’s tax system.

TMO’s John Kheit wrapped up the issue nicely in his Devil’s Advocate column saying,

The rough issue is that the EC doesn’t like how low Ireland set its tax rates. These low tax rates for tech companies have resulted in quite an economic boom for Ireland, making it the ‘Celtic Tiger’ of the region.

Ireland likes its big businesses, the jobs they bring to the country, and the financial stability that comes from an employed workforce. Those aren’t benefits Ireland’s government will simply give up to appease the EU.

Get Ready for the Fight

With the appeals coming, the EU needs to be ready for a legal fight with Apple, but that shouldn’t be its biggest concern. Ireland is appealing, too, and that means the EU has to square off against one of its member countries along with one of the most valuable companies in the world.

The appeals process is expected to take upwards of four years, and it may not play out well for the EU even if Apple has to pay the €13 billion in the end. This is the kind of fight that could put a permanent wedge between Ireland and the EU, ultimately leading to a less stable union.

With the United Kingdom’s recent referendum to leave the EU still fresh, it’s easy to see how other countries could make a similar decision—regardless of whether or not it’s in their best interest. The EU has a real fight on its hands now, and the ultimate outcome could be far more than the €13 billion it says Apple owes.

0 Response to "EU Says Apple Owes €13B in Back Taxes, and the Fight is On"

Post a Comment